Why Hard Money Georgia Is the Best Option for Rapid Real Estate Funding

Why Hard Money Georgia Is the Best Option for Rapid Real Estate Funding

Blog Article

Browsing the Refine: What to Anticipate When Obtaining a Hard Cash Car Loan

Using for a hard cash financing can be a nuanced process that requires a tactical technique to ensure success. Comprehending the important steps-- from gathering crucial paperwork to browsing residential or commercial property appraisals and funding approvals-- can significantly influence your experience.

Comprehending Hard Cash Car Loans

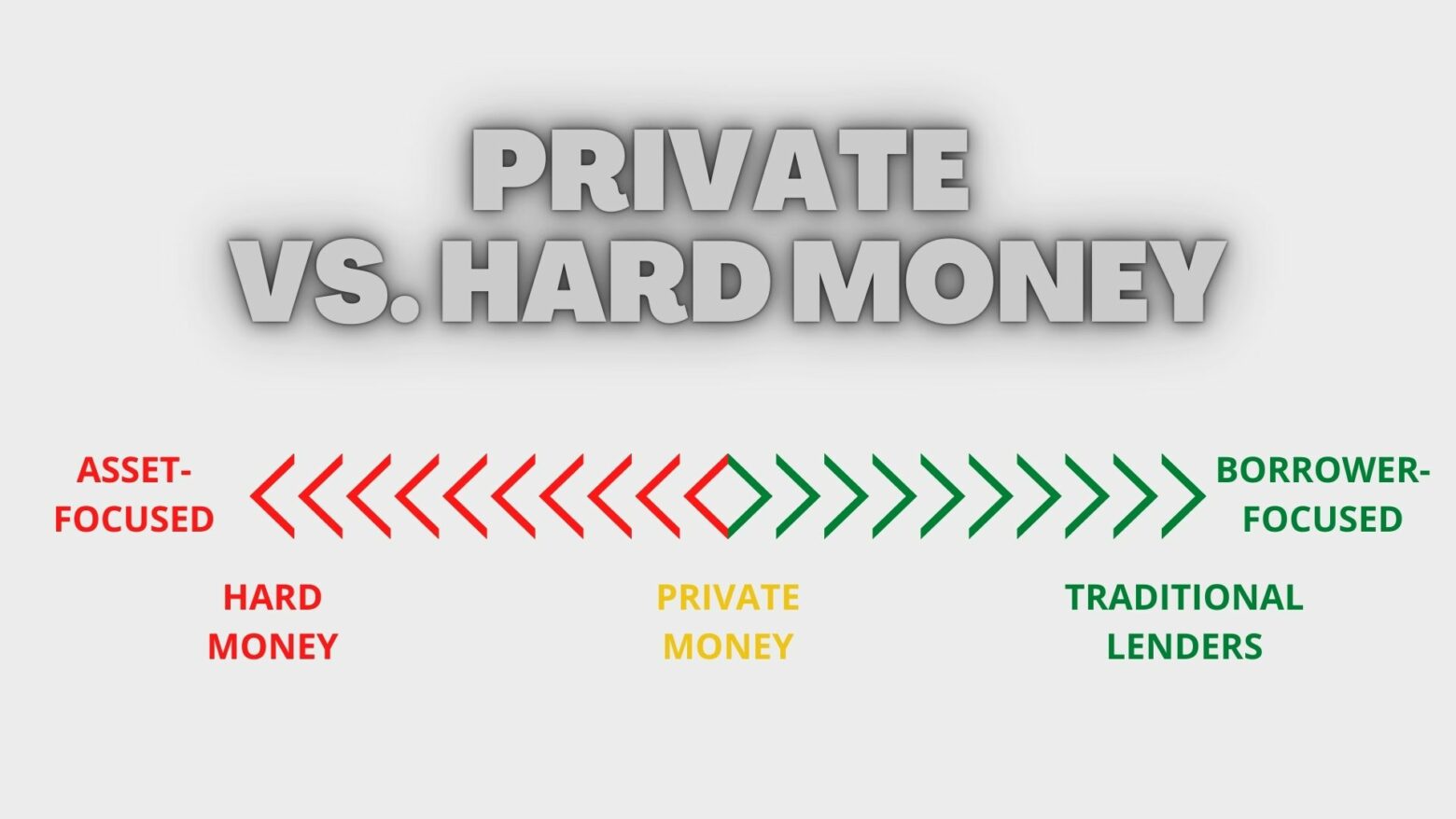

Hard money loans stand for a significant choice to conventional funding approaches, particularly in realty deals. These financings are usually protected by the residential property itself rather than depending greatly on the debtor's creditworthiness. Because of this, difficult cash car loans are commonly provided by exclusive loan providers or financial investment teams, making them accessible to individuals or organizations that might face challenges acquiring traditional financing.

Among the specifying characteristics of tough cash financings is their expedited authorization process. Unlike traditional fundings, which might take weeks or even months for underwriting and authorization, hard cash loans can commonly be safeguarded within an issue of days. This speed can be specifically beneficial in affordable real estate markets, where time-sensitive possibilities occur.

In addition, hard cash lendings typically come with higher interest rates and much shorter payment terms compared to traditional lendings. Financiers often utilize hard cash finances for fix-and-flip projects or to rapidly get buildings before safeguarding lasting funding.

Preparing Your Application

When getting a difficult cash financing, it is necessary to extensively prepare your application to boost your chances of approval. Lenders in this area commonly prioritize the property's value over the customer's creditworthiness, but a well-organized application can still make a significant effect.

Start by gathering all necessary documents, such as proof of earnings, bank statements, and any kind of pertinent financial declarations. Although tough money lenders are less concerned about credit rating, providing a clear economic image can instill confidence in your application. Furthermore, consist of a detailed finance proposition describing the objective of the funds, the quantity requested, and your settlement strategy

Take into consideration supplying a summary of your property experience or previous jobs, if relevant. This demonstrates your capacity and boosts lender depend on. Make sure that your application is devoid of errors and very easy to check out, which mirrors your professionalism and reliability.

Residential Property Valuation Refine

Commonly, the home appraisal procedure for a tough cash finance entails an extensive evaluation of the security being offered. This procedure is vital, as the lender mostly depends on the value of the home to protect the loan. Unlike standard loans, where credit reliability plays a significant function, hard cash lendings focus on property evaluation.

The analysis typically includes an extensive examination of the building by a certified appraiser or actual estate professional. They examine various factors, such as place, problem, size, and similar sales in the area, to determine the fair market price. Additionally, the evaluator might review any possible issues that might influence the building's worth, such as essential repair work or zoning restrictions.

It is essential for debtors to prepare their home for this evaluation by guaranteeing it is cost-free and well-maintained of significant issues. Offering any type of appropriate paperwork, such as previous appraisals or renovation documents, can likewise assist in a smoother valuation procedure. Inevitably, an effective assessment can considerably affect the terms of the lending, consisting of the amount authorized and the interest rate, making it a critical action in protecting a tough money loan.

Car Loan Authorization Timeline

After finishing the residential or commercial property evaluation process, consumers can expect the finance approval timeline to unfold swiftly contrasted to traditional funding approaches. Difficult cash financings are directory normally defined by their quick approval processes, largely due to the asset-based nature of the loaning model.

As soon as the evaluation is total, lenders usually require a few extra files, such as evidence of this post earnings and recognition, to settle their evaluation. This documentation process can frequently be finished within a couple of days. Following this, the loan provider will certainly evaluate the home's worth and the consumer's credit reliability, though the latter is much less emphasized than in traditional financings.

For the most part, debtors can anticipate preliminary approval within 24 to 72 hours after sending the needed records. This fast action is a considerable benefit for financiers wanting to take time-sensitive possibilities in realty.

Nonetheless, the final authorization timeline might vary slightly based on the loan provider's workload and the complexity of the financing. Normally, consumers can expect a complete authorization procedure varying from one week to ten days, enabling them to move promptly in their financial investment quests. On the whole, the structured nature of hard cash offering deals an unique side in the competitive real estate market.

Closing the Financing

Closing the lending notes the final action in the difficult money providing process, where both parties define the arrangement and transfer funds. This stage generally involves a collection of important jobs linked here to ensure that all economic and legal obligations are satisfied.

Prior to closing, the consumer ought to plan for a last review of the car loan terms, consisting of rates of interest, payment schedules, and any costs related to the lending. It is crucial to deal with any kind of final questions or worries with the lender to avoid misunderstandings.

Throughout the closing meeting, both parties will certainly authorize the needed documents, which may consist of the funding arrangement, cosigned promissory note, and safety arrangement. The lending institution will certainly additionally call for proof of insurance policy and any other problems stated in the loan terms.

When all files are authorized, the loan provider will pay out the funds, commonly via a cable transfer or check. This transfer may take place right away or within a few organization days, depending upon the loan provider's plans. After shutting, the debtor is formally in charge of repaying the funding according to the agreed-upon terms, noting a new phase in their economic journey.

Final Thought

In recap, navigating the process of applying for a hard cash financing needs mindful prep work and understanding of essential elements. A thorough understanding of these elements facilitates a smoother experience and enhances the probability of securing the wanted finance effectively.

Unlike standard loans, which might take weeks or also months for underwriting and approval, hard cash financings can often be secured within a matter of days.Additionally, hard money financings usually come with higher passion prices and shorter settlement terms compared to traditional lendings.Typically, the building assessment procedure for a hard cash financing involves an extensive evaluation of the collateral being supplied. Unlike typical finances, where credit reliability plays a considerable role, difficult money lendings prioritize asset valuation.

Ultimately, a successful assessment can substantially influence the terms of the financing, including the quantity authorized and the passion rate, making it a crucial step in safeguarding a difficult money lending.

Report this page